Fundamentals of IBC: Financial Creditor v. Operational Creditor

Introduction

Insolvency and Bankruptcy Code, 2016 (‘Code’) recognizes two kinds of debts that are usually referred to during the process of corporate insolvency resolution:

- the ‘financial debt’ which is defined under Section 5(8) of the Code

- the ‘operational debt’ which is defined under Section 5(21) of the Code

On the basis of the said distinction, the Code identified two kinds of creditors i.e. ‘financial creditor’ (to whom a financial debt is owned by the Corporate Debtor) and ‘operational creditor’ (to whom a financial debt is owned by the Corporate Debtor). However, the Code creates various distinctions in the treatment granted to them in terms of (i) right to apply to NCLT (scope of adjudication), (ii) rights as a member of the Committee of Creditors (‘CoC’) (iii) right to receive amounts under Resolution Plan and upon liquidation of the Corporate Debtor, inter alia.

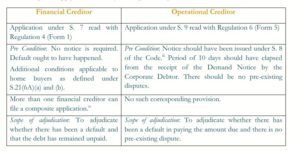

1. Right to Apply before the Adjudicating Authority

Note: The pre-conditions specified herein are in additional to those applicable to both [like limitation, quantum of debt being atleast INR 1,00,00,000/- (Rupees One Crore Only) which was earlier fixed as INR 1,00,000/- (Rupees One Lakh Only)]. Further, S. 11 of the Code prescribes for certain category of entities who are disabled from making an application.

2. Right as a member of the Committee of Creditor

Note 1:For home buyers and other categories of financial creditors named in Section 21(6A), they have a right of participation in the meeting of the CoC only through their appointed authorised representative.

Note 2:For submission of claims before the Resolution Professional, there is a further categorization both under Operational Creditors and Financial Creditors as provided under the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (‘CIRP Regulations’).

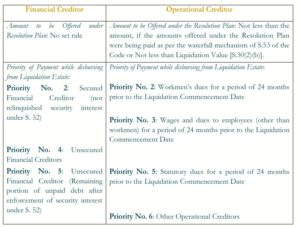

3. Treatment under the Resolution Plan and during Liquidation

Intelligible Differentia in the Distinction: Supreme Court

This differential treatment and preference granted to ‘Financial Creditors’ over ‘Operational Creditors’ was challenged before the Hon’ble Supreme Court of India in the judgment in the case of Swiss Ribbons Pvt. Ltd. and Ors. vs. Union of India.

The classification was contended to be discriminatory and violative of Article 14 of Constitution of India and that there was no intelligible differentia having relation to the objects sought to be achieved by the Code. The Supreme Court had occasion to refer to and analyse the Bankruptcy Law Reforms Committee’s Report, Insolvency and Bankruptcy Bill and Insolvency Law Committee’s report (the literature that led to the promulgation of the Code).

The Court held that preserving the corporate debtor as a going concern while ensuring maximum recovery for all creditors being the objective of the Code; financial creditors are clearly different from operational creditors. Therefore, it was conclusively held that there is obviously an ‘intelligible differentia’ between the two which has a direct relation to the objects sought to be achieved by the Code).