The role of a “surveyor’s report” in assessment of an insurance claim

A. Introduction:

In India, insurance law plays a pivotal role in ensuring that claims made by policyholders are properly assessed and processed. The central piece of legislation in India which governs the raising and settlement of insurance claims in India is the Insurance Act, 1938 (hereinafter referred to as the “1938 Act”). In addition to the central legislation, the insurance sector is also governed by various rules and regulations enacted and amended from time to time.

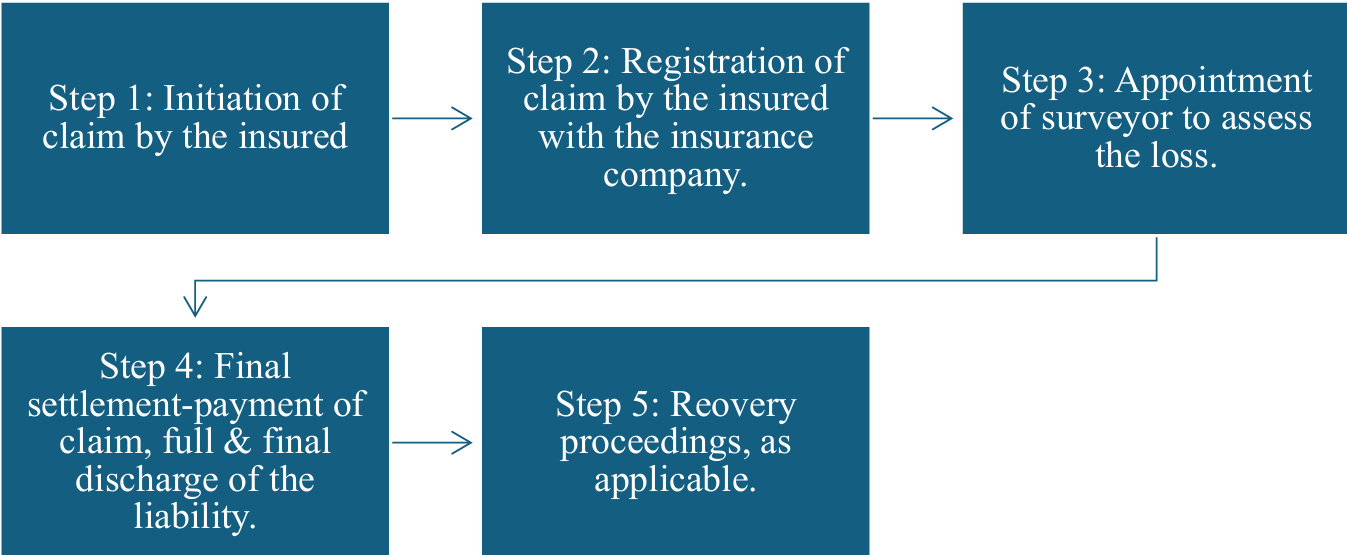

Every time an incident occurs, a claim to be either paid or repudiated has to pass through several stages. The stages of an insurance claim can be understood from the flowchart as stated below:

One of the most critical elements in the claims settlement process, is the surveyor’s report. This document, prepared by an independent professional, acts as an impartial assessment of the loss or damage claimed under an insurance policy. This article examines the crucial role of surveyor’s reports in the settlement or repudiation of insurance claims. Through an analysis of various judicial pronouncements, we explore the significance and evidentiary value of these reports in adjudicating claims filed by insured parties. The investigation in this article delves into how surveyor reports influence decision-making processes within insurance companies and their impact on claim outcomes. By scrutinizing landmark cases and recent legal developments, this study aims to provide a comprehensive understanding of the surveyor’s function in the insurance landscape, shedding light on the delicate balance between the interests of insurers and the rights of the insured.

B. Who is a surveyor & what is a surveyor’s report:

A “surveyor” as defined under the Insurance Regulatory Development Authority (Insurance Surveyors and Loss Assessors) Regulations, 2015 (hereinafter referred to as the “2015 Regulations”) is “a person who is licensed by the Authority to act as Surveyor and Loss Assessor”.1Regulation 2(14) of the IRADA (Insurance Surveyors and Loss Assessors) Regulations, 2015 A person/ corporate entity to be registered surveyor has to obtain licensee in terms of Regulations 32Regulation 3: Application for, and matters relating to, grant of license to individual Surveyors and Loss Assessors and 43Regulation 4: Application for grant of fresh Corporate Surveyor and Loss Assessor License and related matters of the 2015, Regulations.

Further, any loss that is reported under a general insurance product that exceeds Rs.50,0000 or more (in case of motor insurance) and Rs. 1,00,000 or more (in case of other than motor insurance), needs to be mandatorily surveyed by a registered surveyor.4Master Circular on Protection of Policyholders’ Interests, 2024, IRADA Furthermore, the allocation of surveyor needs to be done within a period of 24 hours of reporting of claim.

Under the 2015 Regulations, surveyors and loss assessors are bound by a statutory obligation to submit their reports to insurers promptly. The 2015, Regulations stipulate that these reports must be filed within 30 days of the surveyor’s appointment. Additionally, the surveyor is required to provide a copy of the report to the insured, which includes comments on whether the insured consents to the assessment of loss. It is only under special circumstances, either due to its special and complicated nature, the surveyor shall seek an extension, in any case not exceeding six months from the insurer for submission of the surveyor’s report.5Regulation 13 (2), IRDAI (Insurance Surveyors and Loss Assessors) Regulations, 2015 Thereafter the insurer is required to decide on the claim within seven days of receipt of the surveyor’s report or after expiry of fifteen days from allocation of the claim to the surveyor whichever is earlier.

In simple terms, a surveyor’s report addresses the claim on the elements pertaining to identification of policy and claim, cause and extent of loss, assessment of quantum, and policy compliance by the claimant/ policy holder. Based on these factors and investigation conducted to gather the aforesaid information, a surveyor recommends whether the claim should be accepted or denied; and if accepted, what amount is payable to the policyholder. The 1938 Act while assigning a role for the assessment of loss on surveyor, casts an obligation on him to comply with the code of conduct in respect of his duties, responsibilities and other professional requirements as specified by the regulations made under the 1938 Act. The breach of such obligations may give rise to an allegation of deficiency in service.6Section 64 UM (2)

Pertinently, even though a surveyor’s report is a key determining factor for settlement of claims and has a statutory recognition, it is not statutorily binding on insurance company or the insured. The insurer has the right to call for an independent report from any other surveyor or loss assessor. The 1938, Act only mandates that while settling the claim, assistance of surveyor should be taken but it doesn’t go further and say that the insurer would be bound by whatever the surveyor’s report has quantified. If, for the reason, the insurer is of the view that certain material facts ought to be taken into consideration while framing the report and the same has been omitted by the surveyor, it can depute another surveyor for the purpose of conducting fresh survey for the estimation of loss.7Sri Venkateshwara Syndicate v. Oriental Insurance Company Limited., (2009) 8 SCC 507 While an insurance company is not bound by a surveyor’s report, it cannot also continuously appoint new surveyors in an attempt to obtain a report tailored to its preferences. However, such subsequent surveyor can be appointed after taking into consideration the necessity of doing so and it must be weighed in the context of relevant facts and circumstances including the deficiencies or omissions in the first surveyor’s report.8New India Assurance Company Ltd v. Sri Buchiyyamma Rice Mill., (2020) 12 SCC 105

C. The Evidentiary Value of a Surveyor’s Report:

The insurance claims are often a subject of dispute before the consumer forums constituted under the erstwhile Consumer Protection Act, 1986 and the prevailing Consumer Protection Act of 2019. In this section, we aim to enquire how the consumer and judicial forums view the surveyor’s report.

A surveyor’s report has a statutory recognition, and is to be relied upon while deciding an insurance claim. It is the basic document which has statutory recognition and can be made the basis if it inspires the confidence of the adjudicating forum and if such forum does not find the need to place reliance on any other material, in the facts and circumstances arising in the case.9 National Insurance Co. Ltd. v. Hareshwar Enterprises (P) Ltd., (2021) 17 SCC 682

The Hon’ble Supreme Court in the case of National Insurance Co. Ltd v. Hareshwar Enterprises (P) Ltd., (2021) 17 SCC 682 made the following observation:

“17…… On the proposition of law that the surveyor’s report cannot be considered as a sacrosanct document and that if there is any contrary evidence including investigation report, opportunity should be available to produce it as rebuttal material, we concur. However, the issue to be noted is as to whether the surveyor’s report in the instant case adverts to the consideration of stock position in an appropriate manner and in that circumstance whether an investigation report which is based on investigation that was started belatedly should take the centre stage. The fact remains that the surveyor’s report is the basic document which has statutory recognition and can be made the basis if it inspires the confidence of the adjudicating forum and if such forum does not find the need to place reliance on any other material, in the facts and circumstances arising in the case…...”

A Consumer Forum which is primarily concerned with an allegation of deficiency in service cannot subject the surveyor’s report to forensic examination of its anatomy, just as a civil court could do. The Supreme Court of India, in New India Assurance Co. Ltd v. Pradeep Kumar., (2009) 7 SCC 787, held that while the surveyor’s report is a key document, it is not final and binding on the insurer or the insured. It must, however, be given due weight unless there is sufficient reason to disregard it. Similarly, in Sri Venkateshwara Syndicate v. Oriental Insurance Company Limited., (2009) 8 SCC 507, the Court emphasized that insurers cannot arbitrarily reject the findings of the surveyor without valid justification, and such rejection could be grounds for alleging deficiency of service. The findings of the surveyor’s report cannot be ignored without proper justification.10United India Insurance Co. Ltd. v. Roshan Lal Oil Mills Ltd., (2000) 10 SCC 19 The Hon’ble Supreme Court in the case of Khatema Fibres Limited v. New India Assurance Company Limited., (2021) SCC OnLine SC 81811Khatema Fibres Limited v. New India Assurance Company Limited., (2021) SCC OnLine SC 818 has made the following observation in this regard:

“38. A Consumer Forum which is primarily concerned with an allegation of deficiency in service cannot subject the surveyor’s report to forensic examination of its anatomy, just as a civil court could do. Once it is found that there was no inadequacy in the quality, nature and manner of performance of the duties and responsibilities of the surveyor, in a manner prescribed by the Regulations as to their code of conduct and once it is found that the report is not based on adhocism or vitiated by arbitrariness, then the jurisdiction of the Consumer Forum to go further would stop.”12Khatema Fibres Ltd v. New India Assurance Company Limited & Anr., 2021 SCC OnLine SC 818

Even though it has been a constant position that the surveyor’s report is not the last and final word in deciding of insurance claims, however a legitimate and cogent13National Insurance Company Limited v. Vedic Resorts & Hotels Pvt. Ltd., 2023 SCC OnLine SC 648 reason has to be produced by the person challenging it to depart from such report.14Sikka Papers Ltd v. National Insurance Company Limited., (2009) 7 SCC 777 In the Khatema Fibre Limited v. New India Assurance Company Limited., (2021) SCC OnLine SC 818 the Hon’ble

Supreme Court of India laid down the principles under which an insured may contest a surveyor’s report. Such a challenge is permissible only if the insured can establish a deficiency

in the report, which must satisfy one of the following conditions:

i. The surveyor failed to adhere to the prescribed code of conduct, encompassing their duties, responsibilities, and professional standards as outlined in the regulations under the 1938 Act (as it was then in force).

ii. There was a deficiency in the quality, nature, or execution of the surveyor’s duties, contrary to the standards mandated by the applicable regulations. Furthermore, the report can be contested if it is found to be influenced by adhocism or arbitrariness.

The rationale in Khatema Fibre’s judgement was relied on in a recent judgement of the Hon’ble Supreme Court titled as S.S. Cold Storage (India) (P) Ltd. v. National Insurance Company Limited., (2024) 2 SCC 46715(2024) 2 SCC 467, to reject the surveyor’s report, for failing to consider relevant facts.

There has been instances where preference has been given more to any other document/evidence over a surveyor’s report. Illustratively, the Hon’ble Supreme Court in the case of National Insurance Co. Ltd. v. Harjeet Rice Mills, (2005) 6 SCC 45, had the occasion to scrutinise whether a report of private investigator can be given preference over a surveyor’s report.16National Insurance Co. Ltd v. M/s Harjeet Rice Mills., (2005) 6 SCC 45 In the said case, the Hon’ble Supreme Court observed that a forum investigating fraud ought to have relied on other piece of evidence available than just relying on the surveyor’s report.

In a recent judgement passed in the case of New India Assurance Company Limited v. Mudit Roadways., (2024) 3 SCC 193 the Hon’ble Supreme Court held that it is undeniable that a surveyor’s report is a document with statutory recognition, and under ordinary circumstances it cannot be departed from by the insurance. However, it is equally true that the document which is more conclusive towards disclosing the cause of incident giving rise to a claim shall be considered and mere presence of a surveyor’s report would not be a bar to the same.17New India Assurance Co. Ltd. v. Mudit Roadways., (2024) 3 SCC 193

D. Conclusion:

In conclusion, the role of the surveyor in India’s insurance sector is pivotal, serving as an independent expert in assessing the legitimacy and extent of claims. Their report holds significant evidentiary value, often guiding the insurer’s decision-making process. However, while the report is a key determining factor as far as the decision with regards to a particular claim is concerned, it is not conclusive and can be challenged by either party.